Introduction

Our main purpose in presenting this article is to introduce “swing trading” or ST. First, we analyze its features in detail. Second, we compare it with the day trading method and explain the reason for the superiority of this method. Third, we point to some indicators or tools that Forex traders use in this method. Fourth, we explain the reason why forex traders are interested in this method. Finally, we elaborate on the advantages and disadvantages of this method in detail.

What is “swing trading”?

Swing trading is a method of trading that intends to obtain short- to medium-term profits in the stocks or any financial market in a few days to several weeks. Swing traders fundamentally utilize technical analysis to seek trading opportunities.

Understanding swing trading

Usually, swing trading involves maintaining a situation, either long or short, for more than one trading period. But this period of time usually does not take more than a few weeks or months. This is a total time frame because some trades may take more than a few months, but the trader may still consider them swing trades. Swing trades can also happen during a trading period. however, this is very rare and may happen in extremely volatile conditions.

The goal of swing trading

The aim of swing trading is to access a part of a potential price move. While some traders seek volatile stocks with lots of motion, others may prefer more moderate stocks. However, swing trading is the process of identifying where an asset’s price is likely to move next. It also indicates how the price behaves and how we can use its behavior to our advantage.

Successful swing traders

They are only looking to capture a part of the expected price move and then seek the next opportunity.

Advantages of Swing Trading

1- It requires a shorter time than day trading.

2- The profit is relatively large compared to the time spent.

3- Traders can use technical analysis to make the trading process easier.

Disadvantages of ST

1- Positions opened in this method are subjected to overnight benefits and weekend price charts.

2- abrupt price reversals can cause massive losses.

3- Swing traders often overlook to pay attention to long-term trends to identify short-term trends correctly.

Swing Trading Strategies

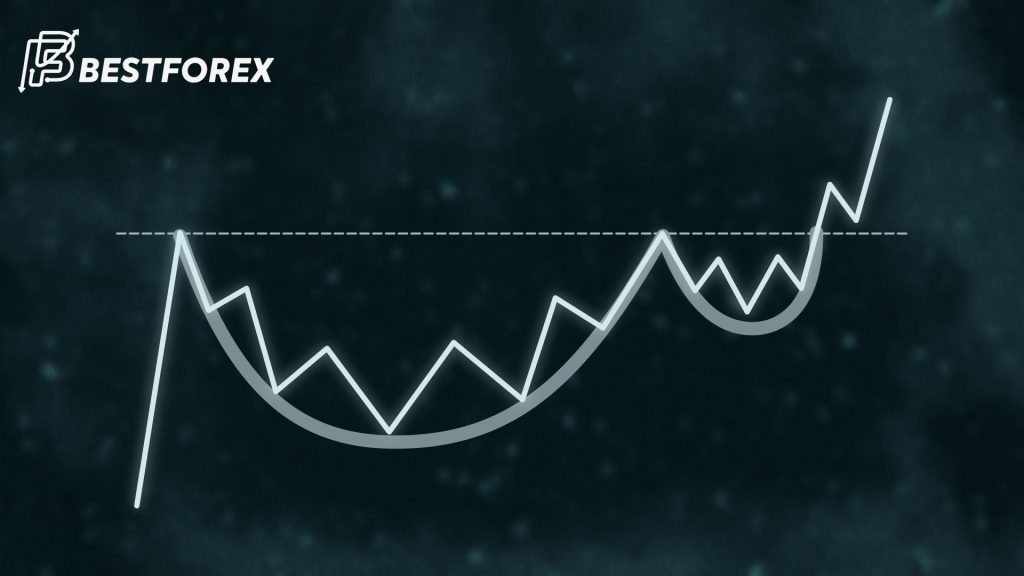

A swing trader tends to seek several-day chart patterns. Some popular patterns are the following: crossovers, cup-and-handle, head and shoulders, flags, and triangles. We can use the main reversal candles in addition to other indicators to design a strong trading plan. Finally, any swing trader comes up with a design and strategy that gives them the edge over other trading methods. This involves seeking trade setups that lead to predictable asset price movements. This is not simple, and no strategy or setup works forever. As long as a trader is content with their risk/reward plan, winning is not always the top priority. The more favorable the risk/reward of a trading strategy is, the fewer times it needs to win.

Forex traders are interested in ST because

1- Swing traders can determine their levels of Take Profit (TP) and Stop Loss (SL) based on technical indicators or price action and use them to regulate and control their risk and reward.

2- This method is one of the most popular trading methods. Traders can use ST to discover mid- to long-term trading opportunities through different technical analysis methods. If you are interested in swing trading, you must be familiar with the concepts of technical analysis.

3- Swing traders basically use technical analysis due to the nature of the short-term investment. “Short-term” here means less than one year because most investments may last for several years.

Fundamental analysis can increase the accuracy of trading. If a swing trader observes an upward trend in the chart, they can also use fundamental analysis to confirm it.

4- Swing traders look at daily charts to find trading opportunities. They may wait for 1 hour to find the right entry point, exit point, TP, and SL.

The difference between day trading and swing trading

Day trading involves making several trades in a day based on technical analysis and complex charting systems. Day traders seek to gain small profits multiple times per day, not holding any trades overnight. Swing traders do not close their positions on a daily basis and instead hold onto them for several weeks. Swing traders will also tend to incorporate both technical and fundamental analysis.

Some Indicators or Tools Used by Swing Traders

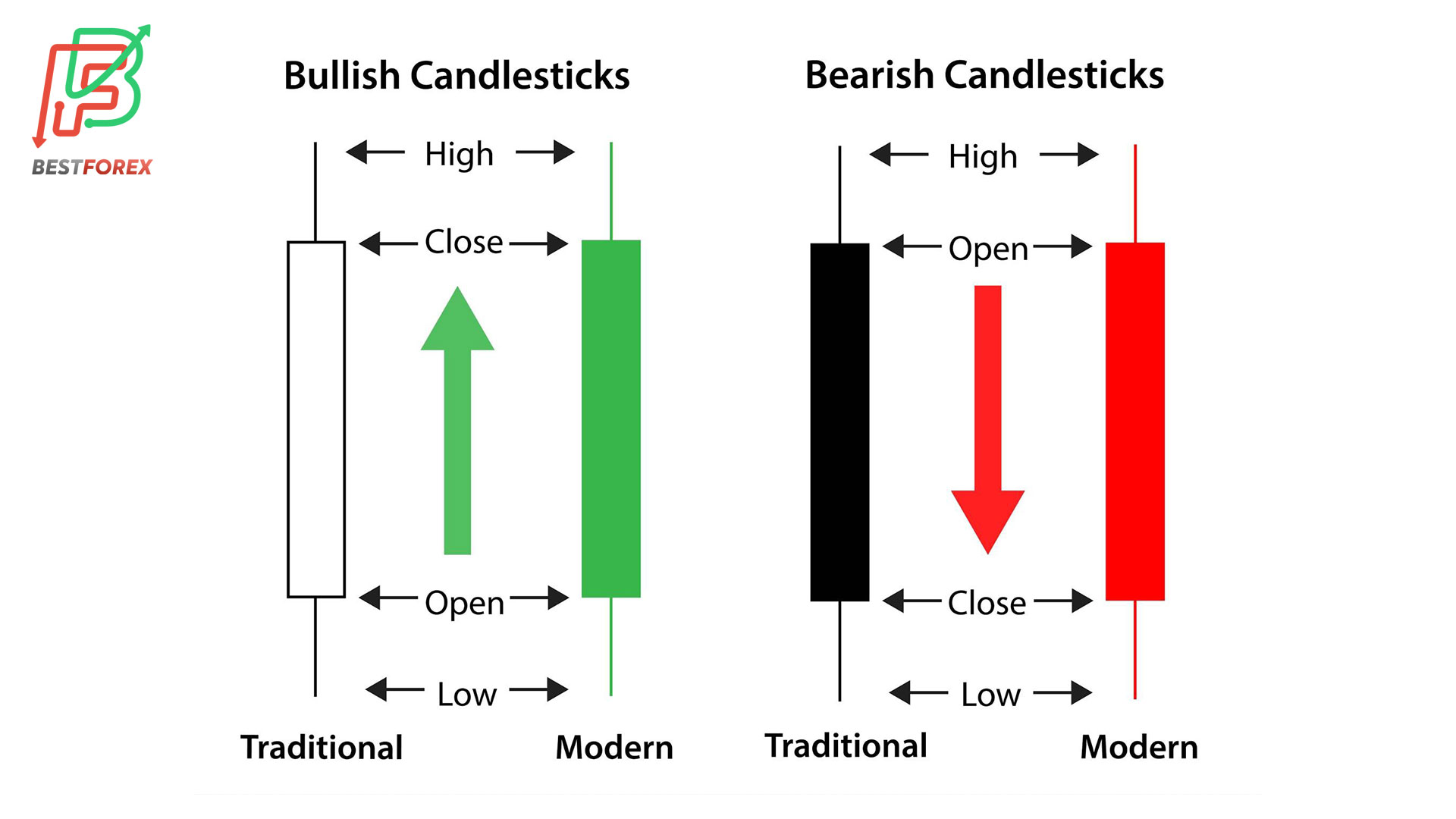

Swing traders will utilize tools like moving averages overlaid on daily or weekly candlestick charts. These tools include the following items: momentum indicators, price range tools, and measures of market sentiment. Swing traders are also on the lookout for technical types like head-and-shoulders and cup-and-handle.

Securities Are appropriate for ST

A swing trader can enjoy success in any number of securities. The best candidates tend to be large-cap stocks, which are among the most actively traded stocks on major exchanges. Swing is also prevailing in actively traded merchandise and forex markets.

Possible Risks of Swing Trading

Although we can find advantages in ST, there are also risks that come with this trading method. The biggest risks concern the final hours of the forex market on the weekends. Market changes could cause a price gap between the market’s closing and opening. A fundamental factor such as a major political event or a natural disaster can widen the gap between the market’s closing and opening. In that case, the swing traders’ position is at high stakes, and they may incur a substantial loss.

What is the peak or Swing High?

Peaks are sequential highs attained before the quick moments of price modification. Sometimes a correction can turn into a trend reversal, which stops the formation of higher peaks.

What is a valley or Swing Low?

A valley is a series of low levels that the price reaches before returning to the high levels. If the current valley is lower than the previous valleys, the overall trend is downward.

In this method, traders prefer to trade only between high and low points, which usually becomes a shorter-term version of ST.

Excellent methods for success in ST

Before you start this method, you should know that the most successful traders have used different strategies. These strategies are introduced by professional traders, and you can use them.

A strong presence before the start of the global market

All people who use this method should prepare themselves to trade before the start of the global Forex market. If they are ready, they can define the target market well. Since the error rate increases when the market is greatly fluctuating, it is best to avoid trading and wait until the chart stabilizes.

Knowledge of market conditions in its initial hours

The most important point that the trader should be aware of is when the market starts working. It is the best time to know about the events of the market day. It is better to refer to official and reliable websites for information about important events. When the market opens, check the overall and in-depth market sentiment and the important information about assets.

Swing Trader methods

It takes time and perseverance to learn the market dynamics. You need to develop methods that are profitable and employ “sound risk-handling techniques”. This might take months or even years.

The more cautious you are, the more time it takes to devise your techniques. ST uses technical analysis, which is based on spotting patterns and acting.

You need to remember that failure is part of your strategy development, and you should learn from them.

You also should have access to technology and the internet. There are several excellent free screeners that will assist you to make a trading resolution. You also need access to real-time price data to make your trading decision.

Kinds of Swing Charting

A popular method in SW is to use swing charts. Swing charting has a relatively easy methodology and provides new data as price action evolves.

New chart objective points are procreated when the new price swings through the objective in the same trend.

What drives the swing price is a filter. Once the price moves the interval targeted by the filter, a new line is made.

The bottom line is that a swing chart will display the trend in swing price movement for the least size, regardless of the time it takes to make the price move.

Choosing the best position to trade

The research done before the market starts and in its early hours provides important information for you. The first step you should take after finding the desired target market is technical and fundamental analysis. The trader must consider the level of risk, which leads the trader to make trades that are more profitable.

What are the best swing trading strategies?

In order to succeed in this method, you need to employ the proper tactics in addition to market analysis tools.

Failure strategy (resistance)

In this strategy, you need to use the following indicators. You need volume data and moving averages to distinguish the signal of sudden upward movement in the market.

When the direction of a major resistance level changes. The trader enters a buy position and keeps their position open until it reaches the price ceiling. Since the uptrend may continue for several days, the swing trader should always maintain the position.

Supportive breakout strategy

This strategy means exiting a trade or opening a sell position exactly before the price drops. This method, also known as a descending breakout, is the opposite of the failed strategy.

Correction strategy

In the corrective strategy, the trader seeks to find moments in the market when the direction of the price is changing temporarily. We can consider this strategy as a larger trend.

The Relative Strength Index (RSI) is an excellent indicator of this strategy. Because it can show the starting point of a change in price direction. Since this change in price direction is temporary, swing traders must determine carefully when to change positions.

The best feature of swing trading

One of the positive features of swing trading is related to traders who do other things besides trading. This trading style is suitable for people who are full-time employees or students and do not have the possibility to access the system at all times.

There is no need to persistently monitor your trading functionality. You can go back to your trades for a few minutes a day and check how they are doing.

For Whom is Swin Trading not Appropriate?

The ST method cannot be an excellent option for people who are constantly checking the chart. These people may stay away from a position that could lead to profit in short-term fluctuations.

It is also possible that the trader does not observe the tactics in opening swing positions. Traders who cannot stick to their strategies are not likely to benefit from swing trading. Generally, you can check the market situation, but volatility is an integral part of financial markets.

Important for traders

If you want to do swing trading, consider setting an SL to prevent potential losses. If you set high SL levels for your positions, you may need to flow more capital into the market.

The important thing to consider regarding this type of trading is that you need to be patient. You have to wait for the market to move towards the target you desire. This is also the reason for the failure of some traders. They do not allow the market to move toward the target.

The final word

A swing trader is someone who trades over a period from several days to several weeks. In fact, this method causes the trader to consider the market’s larger trends and benefit from them. Remember that ST is appropriate for medium-term swings, which traders can use specifically.