Trading strategies are a set of guidelines that help traders develop an organized approach to trading. There are many trading strategies for traders to choose from. The important thing to consider when choosing a Forex trading strategy is your preferences. No single trading strategy includes all the criteria a trader is looking for. Therefore, traders should consider factors such as the size of their capital, timing, personal characteristics, etc. In this article, we introduce some of the most winning trading strategies of all time. Traders can make a selection of the blow strategies that best suit their interests.

1- Day Trading

Day trading involves buying and selling a currency pair within a day to profit from the currency price velocity. Day traders aim to take advantage of short-term and small price movements. They are professional and experienced, which helps them identify false trading signals. Trading for day traders is not a wild adventure into the financial markets. Instead, it is the source of all or part of their regular income. Day traders must have a profound knowledge of the market and its internal and external influential elements. Furthermore, they should have sufficient risk capital to invest in the market and trade based on a plan that includes risk and money management.

This method can yield quick gains if the trader has a comprehensive and practical trading pattern. Otherwise, there is a thin line between trading and gambling. Day trading per se involves a short-term analysis of the market but getting to that stage demands a long-term investment in the trader’s capabilities. Traders must be disciplined, realistic and in control of their emotions. Day trading is like an umbrella term and has some common grounds with other trading strategies explained below.

2- Trading According to the Trend

One of the safest Forex trading strategies is trading in the direction of the trendline. In this method, traders have to find out whether the chart is bullish or bearish and how long it has been so. This gives traders a general understanding of the trend strength and an estimated point where the trendline may reverse. Of course, even in a strong trend, there are fluctuations that may result in small losses. Traders can survive the fluctuations by setting proportionate Take Profit (TP) and Stop Loss (SL) levels. The best thing to do when using his strategy is to wait until assuring a trend is strongly formed.

How to identify the Trend Line?

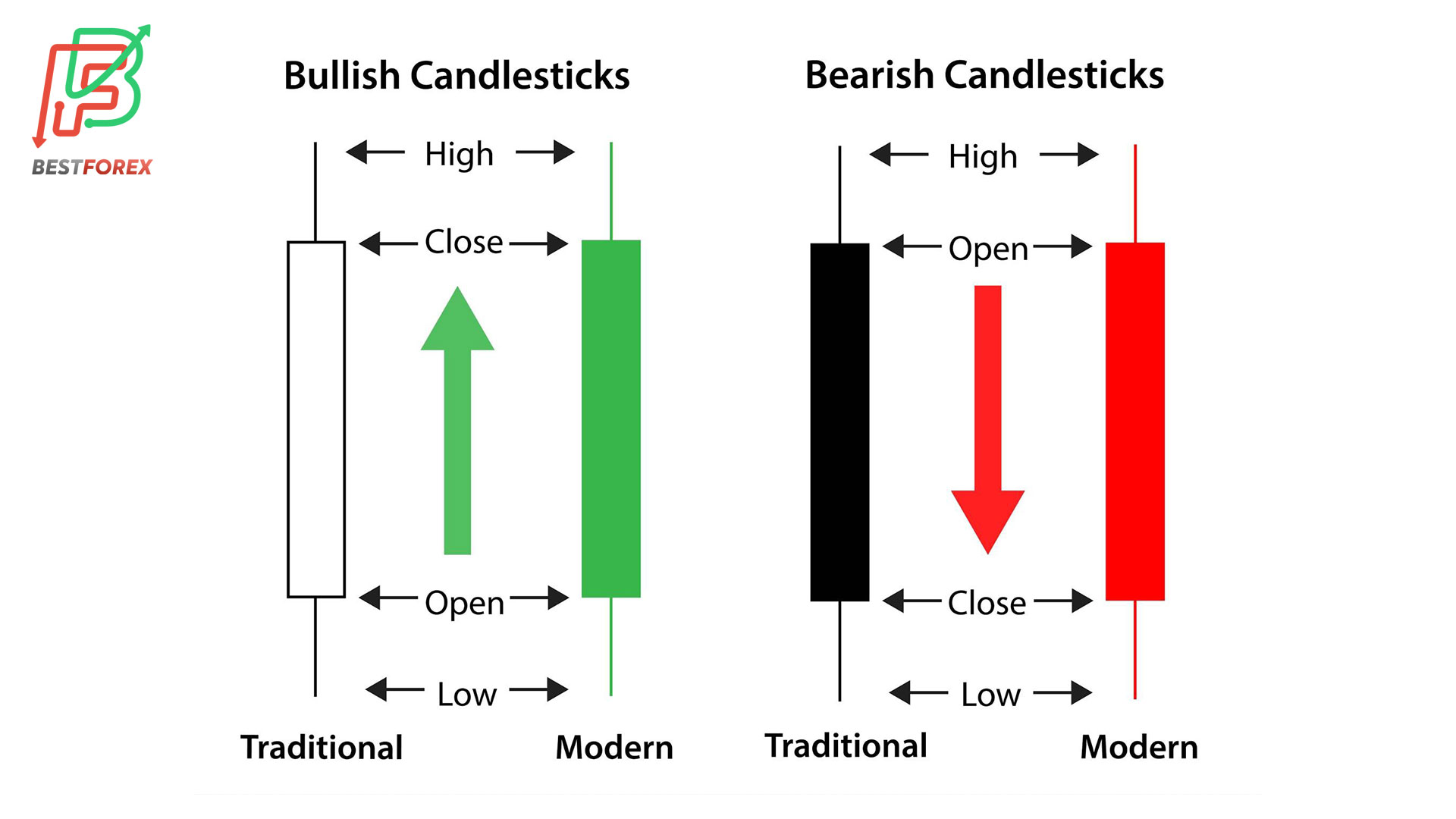

Connecting a series of lows or highs on a candlestick chart is a widespread way of identifying the trendline. By connecting the low points, traders can identify the upward trend and the resistance level for upcoming candles. Likewise, connecting the high points will yield an upward trend.

Moving average is another great tool for extracting the market trend. Traders usually apply multiple moving averages with long, mid, and short-term spans to better comprehend the trend direction. When a long-term moving average crosses a short-term moving average, it usually signals a change of trend. Additionally, exponential moving averages indicate the trend line by focusing on the recent candles.

3- Holding on to your Position

Some traders cannot afford the time to regularly check on the market and look for profitable trading opportunities. Position holding is a suitable trading strategy for traders who prefer to open a position and wait for several weeks, months or even a year to gain profit from their position. Position holders need to have a macro perspective of the market. They should also deposit enough money into their accounts to survive fluctuations and lock in profit at regular intervals.

4- Trading Based on the News

Forex is an international market, and the value of each country’s currency reacts to its economic events. Such events can increase or decrease the respective currency value compared to other currencies. Traders can analyze the news, particularly those related to the major currencies and trade, based on their perception of the news and its impact on the market. Some of the notable economic events include interest rates, unemployment rates, inflation rates, etc. Of course, there are other significant socio-political events, such as coups or revolutions, as well as natural disasters, that affect the currency value. However, these force majeure conditions are not reliable sources in news trading.

Traders who use this method have an eye on economic calendars to predict the price direction and an eye on technical analysis indicators to find the best entry point. Timing is essential here because it can increase profits. Yet, if the trader opens a position too soon without considering multiple aspects of the news, they may incur losses. In other words, in news trading, the results of fundamental analysis have priority over that of technical analysis.

5- Carry Trading Strategy

Carry trading is a long-term strategy that requires keeping a position open for months or years. The profit gained by using this strategy comes from trading high-interest against low-interest-rate currencies. In carry trading, the trader benefits from swapping currencies and the exchange rate. This strategy heavily relies on fundamental analysis. Traders should take the statements issued by the central bank into consideration and be aware of interest rates.

The carry strategy can result in three scenarios. First, the price of the high-interest currency you bought will increase against the low-interest currency. In that case, the trader benefits both from the exchange rate and the difference between the interest rate. Second, if the value of the high-interest currency does not change compared to the low-interest currency, the trader will only benefit from the leveraged trade. Third, the value of the high-interest currency decreases in comparison with the low-interest currency. Consequently, the trader does not profit from swapping but receives the interest of full position value.

6- Trading when the Market is Ranging

Another Forex trading strategy is range trading which is based on support and resistance lines. For range traders, the direction of the trend is not important. All they look for in the candlestick patterns is that the price moves between the support and resistance lines. When a candle is closed higher than the previous high or lower than the previous low, they form a new resistance level. The upcoming candles react to these levels, and when they reach the resistance line, traders expect a change in the trend. Technical analysis tools used for this strategy include a stochastic oscillator and Relative Strength Index (RSI). The advantage of this method is that traders do not need to predict the market direction. They should wait until the change in trend is confirmed, though.

7- Swing Trading Strategy

Swing trading is another short-term strategy based on the data extracted from minute and hourly chart analysis. Swing traders also analyze the weekly time frame to get a general picture of the price movements. This method requires traders to monitor the market and promptly take advantage of the buying/selling opportunities. The difference between swing and day trading is that swing traders may have to hold on to their position overnight.

Swing traders get help from both technical and fundamental analysis. They watch the news to evaluate the asset’s price and use moving averages and time indicators to find the right entry point. The desired price movement in this method involves fast and considerable changes in the asset’s price. Therefore, swing traders must act instantaneously based on the chart. In other words, traders who need time to make a decision and are not that intuitive will not be comfortable using this method.

8- Scalping Trading Strategy

If you are not the type of person who can sit somewhere doing nothing, scalping is not the right choice for you! Scalpers are traders who prefer many small wins over a wholesome profit. They open as many positions as the time allows to gain infinitesimal wins from each position. Scalpers should have a multidimensional perspective of the chart timewise. They must be highly focused and in control of their emotions. For example, in a long position opened based on scalping, the trader quickly sells the asset when the bid price gets higher than the ask price. However, scalpers must take the spread into consideration and trade in time frames when the spread is low. We should note that holding on to a position overnight is forbidden in swing trading.

The trick of the trade for this method is choosing a functional broker. Brokers earn a major part of their income from the spread. Therefore, scalpers should find a broker that has a special account for professional traders to reduce the spread. More importantly, since time is a determining factor in swing trading, traders should choose a platform with a rapid response time. Also, the broker should have a well-developed API section so traders can benefit from automatic trading mechanisms. For instance, pattern recognition programs that work based on machine learning can enormously save the trader’s time.

9- Retracement Trading Strategy

There are movements in a trendline that reverse the trend for a short while but then yield to the direction of the dominant trend. Traders find the retracements using technical analysis tools such as Fibonacci. This allows them to distinguish between retracements and reversal (when the trendline changes direction). The significance of this method is in determining whether you should hold on to your position or let go. That is, if the trader knows that the opposite movement is a retracement, they keep their position open. However, if the Fibonacci analysis signals a new trend, they should close their current position.

10- Grid Trading Strategy

Grid trading strategy refers to the method wherein traders take advantage of the turning points on the chart. In a nutshell, grid trading is trading in the breakouts. Based on grid trading, the trader sets several SL points around the asset’s current price. As a result, a corresponding order will be executed no matter in which direction the price moves. To use this method, first, the trader identifies the support and resistance lines and then places orders within the gap between the two levels. Traders who use this Forex trading strategy should be able to manage several positions simultaneously.

The strength of grid trading is that traders do not need to know the price direction. Therefore, they do not need to constantly monitor the market. Also, grid traders can use the strategy to set orders for the next day. However, traders should still watch the market so that if a new trend appears on the chart, they cancel the orders in the opposite direction. Also, if the preset TP points are not triggered, the trader might incur losses.

Devising your own strategy

As stated earlier, knowing what you want and how you can achieve it is vital before choosing a Forex trading strategy. It is best for novice traders to start with mid to long-term trading strategies. Short-term Forex trading strategies that require immediate action can agitate novice traders and bring about hefty losses. Furthermore, not every strategy can be applied to every market. It is vital to understand the price movements to see whether your strategy can be applied to the current market status or not. We strongly recommend that traders choose a broker that provides a demo account. The feature allows novice traders to familiarize themselves with the platform’s trading interface and professional traders to test their strategies before using them in real time.

Overall, strategies like day trading, scalping, swing trading, etc., are suitable for experienced traders who rely on trading as a source of income. On the contrary, long-term Forex trading strategies work best for those who have a primary source of income and approach trading as a long-term investment. Finally, we should note that even professional traders experience losses from time to time. Even the most detailed trading plans cannot 100% guarantee the trader’s success in every position. Failure does not necessarily mean your strategy does not work. Traders must be disciplined and consistent in using a trading strategy.

You can research trading strategies in more details at https://academy.investopedia.com/?aca_ref=header_home_link_1.

Disclaimer

The guidelines we mentioned in this article are only for educational purposes. Please do not regard them as financial advice. Note that investing in financial markets requires a comprehensive trading plan. Any rash decision can easily spoil your capital.