Forex Market is the most popular trading market around the globe. Banks, hedge fund institutes, and even governments focus on the forex market to increase their funds through trading and making big profits. However, individual traders trade a very low volume compared to the companies and banks; therefore, they need to manage risk much more than they do. Because when the capital is low, the risk of losing it is more, and you may lose part or all of your capital if you do not manage your risk. Using “Stop Loss”(SL) is one of the most valuable ways to manage risk.

- What is a “Stop Loss”?

- What are the advantages of using a “Stop Loss”?

- Using SL can reduce your risk/loss:

- Using SL can reduce your anxiety:

- Using SL can help you to overcome your emotions:

- What are the disadvantages of using a”Stop Loss”?

- What are the most beneficial techniques for using Stop Loss?

- Stop loss based on support and resistance levels:

- Stop Loss based on a fixed percentage of your balance:

- Trailing Stop Loss:

- How to put a stop loss in MetaTrader 4

- Essential Notes

- Final Words

What is a “Stop Loss”?

Stop loss is a designed tool for traders to dedicate where their order closes if the price does not go according to their predicted direction. But, of course, there is no certainty in the market, and even if you are an excellent technical or fundamental analyst, the market could go in your unexpected way. So, you decide where to close your order if the market goes the opposite to reduce your loss.

In fact, SL is a mental term. You cannot find any rule to determine where to place an SL (although some people try to make it fixed and written, which is also a good thing and we will discuss later in this article), but mostly it depends on your trading strategy, emotions and your investing style. The purpose of any kind of SL is clear: to reduce your loss!

Imagine that you are monitoring the price chart while you have an open order. In this case, you can clearly see when the price is going against your expectations, and you can close it manually when it achieves the level on which you can disappoint that your prediction was wrong or it takes a percentage of your fund, which you cannot effort to lose.

But what if you are not watching the price chart at the moment? You can easily “Call Margin” your account in such a scenario. That is the reason why they build the “SL” tool. Using this tool, you can determine your SL price even before opening your position, and your order will automatically close once the price reaches your SL price. This option has made trading much easier for those not willing to sit behind the desk and look at the screen while trading.

What are the advantages of using a “Stop Loss”?

You have probably understood the importance of using an SL by far, but it has some more benefits, a few of which are mentioned below:

Using SL can reduce your risk/loss:

Through using an SL, you can determine how much of your balance you can effort to lose. However, risk management techniques do not limit to placing SL; it is one of their most effective ways to deal with risks. Therefore, we will thoroughly discuss further risk management methods in the following articles.

When it comes to money management, SL is the most Benefield option in the Forex market. You need to decide how much of your balance you want to involve within an order, but SL helps you also to manage the money you involve in. You may have heard that 90% of the success process in the forex market is money and risk management. So consider SL as your friend who helps you alongside in the success process.

Using SL can reduce your anxiety:

Trading is a stressful job. According to “Forbes” trading is the riskiest and the most lucrative career in the world. That is the reason why great trading companies hire therapists or psychologists to monitor their employees’ mental health. Watching the market all the time could be very stressful. When you look at your positions in the live market, unconsciously, you involve your emotions. Determining a SL makes you needless for monitoring the chart. And also, you are confident that you won’t lose a large amount of money since you have determined that beforehand. Furthermore, this option is convenient when you are on vacation or cannot monitor the chart performance. In other words, using SL gives you extra time in trading. And you can use the time to learn new trading strategies or skills or even rest to calm your body instead of monitoring the price with anxiety.

Using SL can help you to overcome your emotions:

Some traders fall in love with stocks, assets or currency pairs. It means that if they give a stock or currency pair a second chance, the price will return and go according to your order’s direction. This false idea could lead to your “Margin Call”. SL helps you isolate your decision-making and not involve your emotions.

Besides all the benefits listed above, some people count some demerits for using an SL. We will mention some of them in the following lines:

What are the disadvantages of using a”Stop Loss“?

SL might decrease your profit percentage:

If you are a trader, you most probably have faced situations in which the price goes against your prediction. And after reaching your SL, it returns and hits your TP (Target Point). We call this scenario “Stop Hunt”.

The idea of a stop hunt relies on the bank and hedge fund companies’ actions. Some traders believe that, in some cases when the banks and institutions want to get liquidity to increase their funds. So they manipulate the price and hunt other traders’ SL to collect their cash.

We do not want to check whether this idea is accurate or not. But what is evident is that sometimes the market could hit your SL before hitting your TP. Such orders show that your price prediction is somehow correct. But the level you determined as your SL is not good.

That is why it is highly important where to put your SL. The strategy which you use to analyze totally depends on you. No matter if you are using Ichimoku or price action, etc. It is essential to have a trading plan besides a trading journal in which you determine and write the SL technique you want to employ.

What are the most beneficial techniques for using Stop Loss?

As we mentioned before, SL is a mental term. And every trader could have their personal view and techniques for using it. But in this section of the article, we will discuss some most famous ways of using SL.

Stop loss based on support and resistance levels:

Some levels in the market are known as support and resistance levels or the “Piot Points”. These levels are critical since, most of the time, they reject the price. And if the price break through them, that shows the price can go more forward in that direction.

One of the most powerful SL techniques is putting your SL under an important Support level in a “Buy” order. Or to put it under a resistance level in a “Sell” order. If the price crosses a level, there is potential to go forward against your level. And if it rejects from the level, then your SL will remain untouched.

Stop Loss based on a fixed percentage of your balance:

Some traders prefer a fixed SL and do not pay close attention to the support or resistance levels. Instead, they consider some rules based on this technique, such as the 3% rule. In this technique, traders evaluate the percentage they can lose per trade. For example, a trader says that he can have a maximum of 3% per trade. And he evaluates the price at which he will lose 3% and puts the SL on that price. Of course, the 3% could be increased or decreased based on your personal decisions and your capital. But what is mentioned here is that, in this kind of SL technique, you will only lose what you can make an effort to lose.

Trailing Stop Loss:

Some traders want to get the most profit out of the market. Therefore, they believe that it is not professional to have a fixed SL, and it can reduce your profit level. Rather than having a fixed SL, such traders use “Trailing Stop Loss”.

In such cases, these traders monitor the market while they have an open order. As soon as the order enters a safe profit level, they put an SL. Their order is “risk-free”, meaning that even if their SL gets touched, their order will be closed with profit. And if not, they will go alongside with price to make more profit. So every time the price makes a higher high in the “long” or a lower low in the “short”, they trail the SL for more gains.

Attention, this kind of SL (Trailing SL), is very popular and could be very profitable, but it needs a very professional and experienced trader to perform so. Otherwise, it can cause significant losses. Therefore, it is better to have a fixed SL if you are a novice trader.

How to put a stop loss in MetaTrader 4

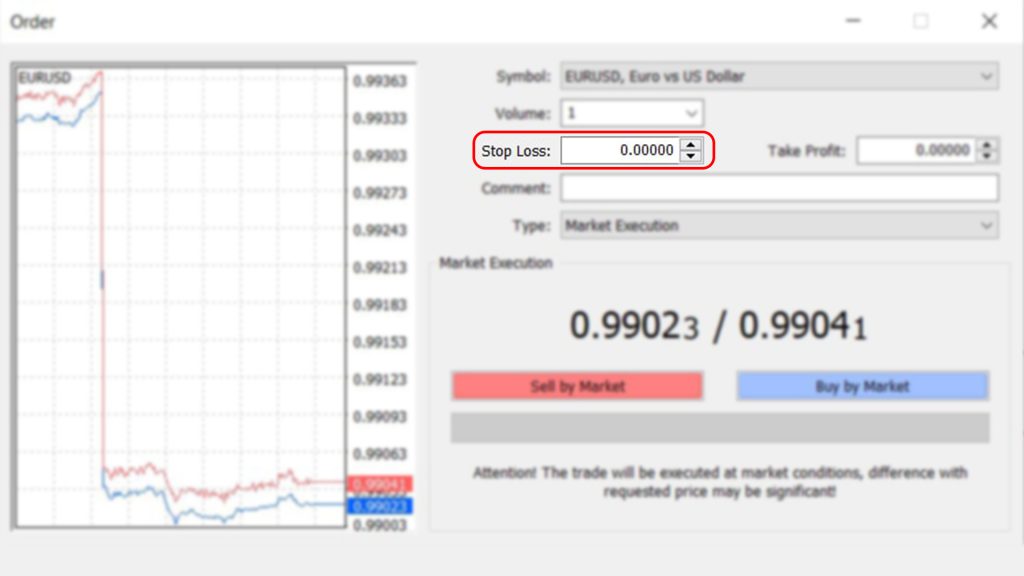

MetaTrader 4 (MT4) is the most popular trading platform globally. In MT4, you can place SL before or after opening an order. You must first click the “New Order” button to set your SL before opening an order. Then, when the new window opens, you can click on the “Stop Loss” tab and enter the price you want to consider as your SL. For example, take a look at the following photo:

You can double-click on the order line if you want to place your SL after opening your order. After that, the same window as the photo above will appear, and you can enter your SL price according to the previous instruction.

Essential Notes

A brilliant SL strategy requires high proficiency in technical analysis and lots of experience. But still, having a SL is much better than not having one.

If you feel that the SLs you place get touched most of the time, try to detect more major support or resistance levels, or increase the percentage, you consider as your fixes SL.

Many professional traders believe that once an SL is placed, it must not be moved if only you want to trail it.

Never make your SL wider. This means that when the price gets close to your SL, do not move it to prevent it from being touched. This action is considered one of the most armature actions a trader can take.

New traders are recommended to use the “set and forget strategy” (We will introduce this strategy in the following articles). But in brief, this strategy means determining your SL and TP before opening an order, and once your trade is opened, you forget about it and do not monitor it anymore. Then, after a while, you come for the result and get the least emotions involved.

Final Words

SL is one of the necessary tools which can grow your trading experience to the next level. Even professional traders attempt to optimize their SL points and employ different methods of placing an SL to get the most profit out of the market. SL not only helps you reduce your risk and loss but also allows you to control your emotions and anxiety. Using SL makes you like an untouchable robot who ignores feelings while trading and intelligently moves toward trading goals based on a well-arranged trading plan. So, next time you hesitate to not place an SL or replace it, remember that you are working in a brutal market waiting for you to make a mistake and then hunt your fund. So, never skip Stop Loss!

20 Word Script (Used By Billionaires) Forces You To Manifest Anything 100X Faster!