Introduction

Cryptocurrency has become a hot topic in the past decade (mainly from 2019), with many investors looking to capitalize on the potential for high returns in the market. However, like any investment, there are risks involved. In fact, more than 90% of investors end up losing all or most of their capital. Therefore, it is necessary for crypto enthusiasts to be aware of the risks of investing in the cryptocurrency market. In this article, we will explore the potential risks of investing in the cryptocurrency market and provide some tips on minimizing those risks.

Volatility

One of the most significant risks of investing in cryptocurrency is its volatility. The value of cryptocurrency can fluctuate wildly in a short amount of time, making it difficult to predict the market. This volatility is due to a variety of factors, including supply and demand, news events, and speculation. For example, in 2017, Bitcoin reached a record high of nearly $20,000, only to crash down to $3,000 in just a few months. Similarly, in May 2021, the value of Bitcoin plummeted by over 50% in a matter of days, causing panic among investors.

To minimize the risk of volatility, it is essential to research and understand the market before investing. Investors should also be prepared to hold onto their investments for an extended period, as short-term fluctuations are more common in cryptocurrency than in other investments.

Security

Another significant risk of investing in cryptocurrency is security. Since cryptocurrencies are entirely digital, they are vulnerable to hacking and theft. Hackers can gain access to an investor’s digital wallet and steal their cryptocurrency, leaving them with nothing. To minimize the risk of security breaches, investors should use reputable exchanges and digital wallets with solid security measures. Additionally, investors should use two-factor authentication and complex passwords to protect their accounts.

Regulatory Risk

Another potential risk of investing in the cryptocurrency market is regulatory risk. Cryptocurrencies are not regulated in the same way as traditional investments, leaving investors vulnerable to changes in regulations and laws. For example, in 2021, China banned all cryptocurrency transactions, causing the value of Bitcoin to drop significantly. Similarly, in 2018, the US Securities and Exchange Commission (SEC) warned that some cryptocurrencies may be considered securities and subject to regulation.

To reduce the risk of regulatory changes, investors should stay informed about any regulatory developments in the cryptocurrency market. Additionally, investors should have a flexible trading plan that they can apply even when there is a change in regulatory policies.

Liquidity Risk

Cryptocurrency is not as liquid as traditional investments like stocks and bonds. In addition, cryptocurrencies can be difficult to buy and sell quickly, making it challenging to take advantage of sudden changes in the market. Therefore, investors should choose reputable exchanges with high trading volumes where both long and short orders are executed quickly. In other words, exchanges with more active users have larger asset pools, and once a trader places an order, it is quickly filled. Also, investors should be prepared to hold onto their investments for an extended period if necessary. As a matter of fact, investors, especially novice investors, can hold or stake cryptocurrencies and look at them as long-term investments; this is much safer than trading spots or futures for newcomers who are not familiar with the market dynamics.

Market Risk

Like any investment, cryptocurrency is subject to market risk. The value of cryptocurrency can be affected by various factors, including global economic events, geopolitical tensions, and technological changes. Investors can reduce the risk of market fluctuations by diversifying their portfolios and investing in a range of assets, including stocks, bonds, and cryptocurrencies. Fundamental market analysis can help investors understand which events have minor or major effects on price movements. It can also help traders understand the intrinsic value of an asset and decide whether the asset’s price will increase or decrease.

Fraud Risk

Fraud is another one of the risks of investing in the cryptocurrency market. Scammers can create fake cryptocurrencies and sell them to unsuspecting investors, leaving them with worthless investments. For instance, PlexCoin ICO, which was shut down by the US Securities and Exchange Commission (SEC) in 2017. The founders of PlexCoin promised high returns to investors and raised $15 million in the ICO. However, the SEC found that the founders had no real product or service behind the token, and the funds raised were used for personal expenses. As a result, the founders were charged with fraud, and investors lost their money.

Moreover, scammers can use social engineering tactics to gain access to an investor’s digital wallet and steal their cryptocurrency. Therefore, investors should research any cryptocurrency before investing. Each crypto project has a comprehensive white paper where the developers explain the technical matters and the project’s aim. White papers are valuable sources of information that help traders distinguish a solid project from a fake one. Click here to learn the factors of a standard white paper.

Technical Risks

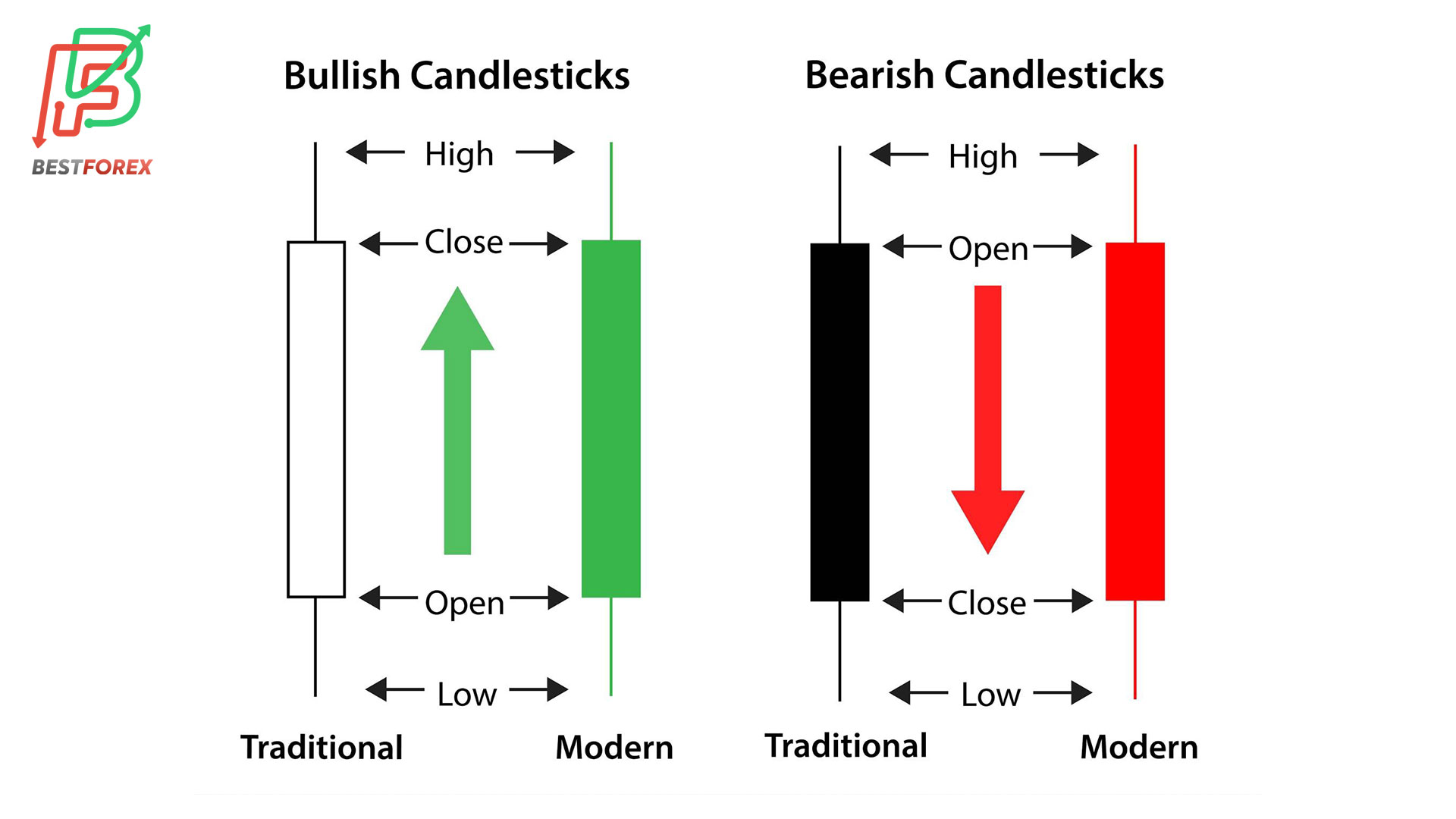

Technical risks are those that arise from flaws in the underlying technology of cryptocurrencies. The underlying technology of cryptocurrencies is known as blockchain, which is a decentralized ledger that records all transactions made on the network. Blockchain technology is highly complex, and even minor technical issues can significantly impact the value of cryptocurrencies. Crypto projects require a deep understanding of blockchain technology and cryptography to fully appreciate their value. Technical risks can arise from flaws in the underlying technology or from human error. For example, a coding error in a cryptocurrency’s smart contract could lead to a loss of funds or a significant drop in the value of the cryptocurrency.

Conclusion

While investing in cryptocurrency can be an exciting opportunity, it is essential to understand the risks involved. Investors should be aware of volatility, security, regulatory changes, liquidity issues, market fluctuations, and fraud. Investors should do their research, diversify their portfolios, and invest cautiously to lower the risks of investing in the cryptocurrency market. Understanding the market and staying informed about regulatory changes or fluctuations can help traders make more informed decisions.

Continue reading about the risks of investing in the cryptocurrency market here.