Introduction

Routine jobs have a fixed income, and the employees may get a promotion once in a while as well. But the thing is that you cannot live a dream life by having a regular job. You have to work smart, not hard! Currency trading is one way to earn as much money as you need for your version of an ideal life. With that in mind, you cannot jump into the Forex trading process without prior training, as you would rather lose your capital than increase it. This article elaborates on providing summarized guidelines and some simple steps of Forex trading that will lay the foundation for your entry into the market.

What is Forex Market?

Forex is short for Foreign Exchange and is also referred to as FX. The forex market is the most significant instance of financial ties among countries worldwide. The market is the avenue to international commerce and investment. Thanks to the FX market’s affiliation with banks and its incredible inflow, the market is famous for its stability. The market is so deep a trader can execute a $500-million trade without significantly affecting the prices. A similar order in other markets can shake the whole market.

How does Forex Market Work?

The forex market is open 24 hours, six days a week, from the start of Monday, working hours in New Zealand, to the end of Friday, working hours in New York. While other markets might be closed on holidays, the FX market is active. The average size of the forex market in 2022 is estimated at around $2.4 quadrillion. Traders that open short-term positions in the market for profits within a few minutes or hours (speculative trades) account for most of the market’s positions, and enterprise traders have a smaller (yet extremely significant) share of the market trades. Moreover, most Forex trading occurs in major currencies, including USD, EUR, and JPY, representing the world’s top economic powers.

Forex Trading Sessions

One of the categorizations of the market is based on time zone. Traders can choose any time zone that suits their schedule. Asia-Pacific is the first time zone which includes New Zealand (NZD), Australia (AUD), and Japan (JPY) as the most influential centers. Of course, JPY has the upper hand compared to other currencies in the time zone, thanks to its market size.

The next session starts around the middle of the Asia-Pacific time zone. The European/London session accounts for more than half of the global trading volume, and London alone has control of about one-third of the global trading volume. This is mainly because this session overlaps with half of the Asia-Pacific and half of the North American session. Therefore, the European/London Session has the highest market liquidity and dept.

Finally, the last session is in the North American time zone and accounts for more than 20% of the global market trading volume. The significance of the North American session is that the USD plays a central role in the forex market. Any change in the value of USD affects the whole market.

Forex Ties with other Markets

Financial markets do not exist in a vacuum, meaning they mutually affect each other. For example, one of the markets closely related to the forex market is the gold market. Gold is an alternative to USD, and people use it to hedge their capital against inflation. In the long term, there is a negative correlation between the two markets, meaning that when the USD value increases, the gold value descends and vice versa. However, in the short term, the correlation is not significant. Another fundamental element that interacts with the forex market is the oil price. Basically, if a country is replete with oil resources and is an importer of oil, its currency would react to the price of oil. The higher the oil price, the lower the currency value. Generally, oil prices can either lubricate or hinder a country’s development and its currency’s value.

How to Trade Currencies?

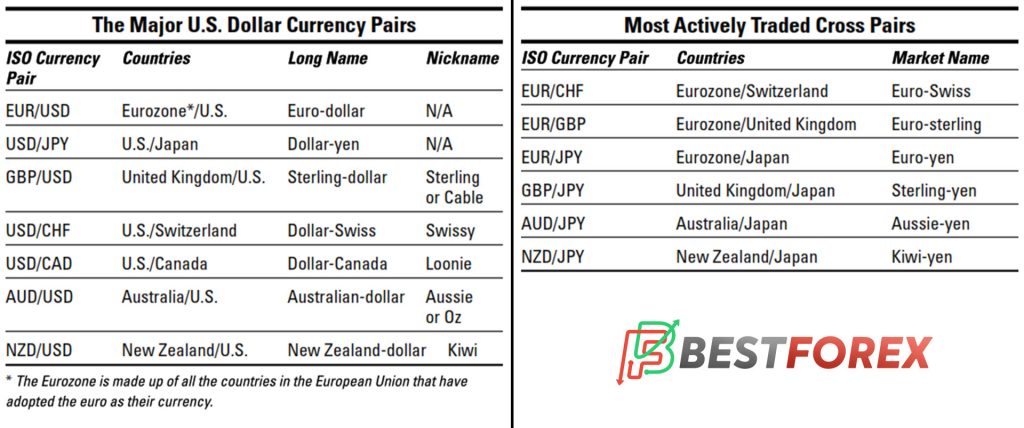

Like any other market, the FX market has a series of conventions that traders need to know. Currency pairs trading involves the simultaneous buying and selling of currencies. For example, if you are trading USD against EUR (USD/EUR pair), you are buying USD and selling EUR. In a currency pair, the first one is the first asset is the base and the second one is the counter currency (AKA secondary currency. All pairs that include USD on one side of the deal are considered major currency pairs, and the currency pairs that do not include USD are referred to as crosses. Nevertheless, crosses are indirectly affected by the USD.

The terms long and short have the same meaning as they have in other markets, but since we are dealing with the simultaneous selling and purchasing of an asset, we should be clearer as we use them. As a trader, you take a long position, which means you want to buy the base currency and sell the counter currency. On the other hand, when you take a short position, it means that you want to sell the base currency and buy the counter currency. One of the leading market strategies in this regard is buying low and selling high. If you have no open positions in the market, you are, as the market jargon suggests, square or flat.

Understanding Forex Trading and Market Terms

Any occupation or profession has a particular lingo. We tried to list some of the most commonly used terms among forex traders below:

Profit and Loss (P&L) in the FX market

It is the indication of your success or failure in your Forex trading experience. P&L determines the trader’s margin.

Margin in Forex Trading

The money the broker lends you so you can keep your position open while the odds are against you.

Unrealized and Realized Profit and Loss

Unrealized (AKA paper) profit and loss is the amount of your potential profit or deficit at the time of calculation before squaring your position. The realized profit or loss refers to when you square your position.

Pip in Forex Trading

Pip (point in price) is the smallest unit in calculating an asset’s price change. The last number after the decimal point is called the pip. For example, EUR/USD: 1.2853, three is the pip.

Lot Size In FX Trading

The standard currency unit size equals 100,000 units of the base currency.

Rollover in Forex Trading

The expansion of the settlement date; is when a position is open from one value date to the next.

Bids and Offers in FX Market

Bid indicates the value of the base currency if you want to go long, and Offer (AKA ask) is the value of the base value if you want to sell it. An easy way to distinguish between a Bid and an Offer is by looking at the price; whichever is the lower one is the Bid, and the more expensive one is the Offer.

Spread in Forex Trading

The difference between a currency pair’s bid and ask value is called the spread. Spread correlates negatively with the commonness of the pair. The more popular the currency pair, the less the spread and vice versa.

Designing a well-performing Forex Trading Strategy

Know thyself!

Novice traders’ most common question is ‘what is the best trading strategy?’ a question that we cannot answer objectively. The best strategy is the one that matches the traders’ characteristics and capital. By way of explanation, if your family or friends describe you as a patient person, you can open positions whose results will be yielded in the long run. On the other hand, if you are eager to immediately see the result of your position, you may open positions that will be closed shortly.

Generally, you have to evaluate your resources and see how much time and money you can spend to learn the market dynamics and invest in the market. Self-awareness is a prerequisite to trading, and traders who ignore this essential factor are doomed to fail. Another important note is that traders must not use the money they cannot afford to lose for trading. Instead, they should use risk capital which is the money that, if lost, will not corrupt the trader’s everyday life.

Stress Management in Forex Trading

People who cannot deal with stress or cannot make the right decisions when under pressure should not enter the forex market without modifying their mindset first. Frustration usually strikes the traders when they are not prepared. That is, they have started trading without having developed a risk management strategy that indicates their market activity limits.

More often, a comprehensive plan can fill the gap between failure and success. Such a plan includes factors such as position size, entry point, and stop-loss and take-profit levels. Naturally, even the most accurate plans cannot help you if you do not stick to them, a frequent phenomenon that happens because traders do not trust their plans or act based on their emotions. Take note that the first plan you come up with is not the best plan. You need to modify its deficiencies, but you should stick with it no matter what.

Technical or Fundamental?

The next step is the comprehension of the market information. The data you can obtain from the market as a tardier is either fundamental or technical. The fundamental information includes the status of other markets in the last 24 hours, changes in governmental policies, especially the U.S government, central banks’ announcements, natural disasters, major political events like revolutions, etc. The technical data are the ones traders can extract from the trading charts. Technical analysis of the market requires a mathematical understanding of the charts, the least of which are the moving averages.

Those in favour of technical analysis are better off with numbers and figures. Those in favour of fundamental analysis are more intuitive. However, you seldom find traders who strictly use one method and discard the other; usually, the technical analysts are observant of the news, and the fundamental analysts wait for a technical signal to open their position.

Different types of Forex Trading Strategies

There are as many trading strategies as there are traders in the market, but this article categorizes the strategies into three main groups:

Short-Term Trading

Short-term trading involves holding a position for as long as a few seconds or, maximally one or two minutes. In this type of strategy, traders take advantage of the pip movements (frequently one to two pips) and quickly open and close multiple positions. We know the traders who use this strategy as scalpers.

Scalpers should be spontaneous and fast as they have only a few seconds to take advantage of the market. Scalpers do not have the time to analyze the market and consider different aspects. Instead, they behave based on their guts and follow their hearts. It does not matter for a scalper if the price goes up or down; they only care about the next few pips that determine their failure or success in the blink of an eye. Scalpers should trade only the major pairs when the market has the highest liquidity. They should avoid trading before the financial or political announcements.

Medium-term Trading

The medium-term positions are usually open or as few as three to four minutes to as long as three to four hours. In such positions, traders should be wary of the trendline and not open any positions against it. Traders that fall under this category should have a broader perspective and more patience to be successful. They should watch the news and other fundamental sources and wait for a technical signal to open their positions. Another point to make here is that medium-term positions are not suitable for the time the market is ranging. The market movement in the ranging period can be from 20 to 50 pips (short-term) or 200 to 400 pips (long-term).

Long-term Trading

Long-term trading is the category that best describes enterprise traders who can put large amounts of money in their positions and are willing to wait for several weeks, months or even years. Speculators should avoid this type of position as they might be unable to withstand the market’s volatility.

Final Words

The Forex market can provide an alternative or additional income. People with the time and money to invest in the market can learn the market dynamics and discipline themselves to take advantage of it. Clearly, ruthless and unprofessional actions can bring about huge losses for investors.